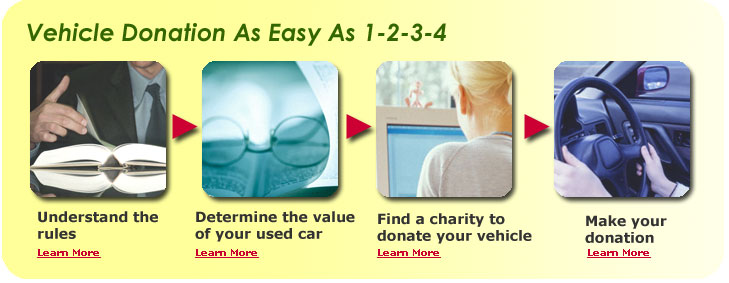

Vehicle Donation Step 1: Understand the Rules

The first step in car donation is to understand the government rules on vehicle donation.

A good place to read the government rule on car donation is IRS Publication 4303, A Donor's Guide to Car Donations (PDF format, available on the IRS's website at www.irs.gov). This guide outlines some important rules regarding car donation. For example, one important rule states that car donation must be made to qualified organizations in order to be tax deductible.

Car donations are generally considered tax deductible if they meet certain criteria. One of the most important rules is that car donation must be made to qualified organizations in order to deduct a charitable contribution on your taxes (IRS Publication 526). However, this guide also goes into detail about what types of vehicles qualify and how much you can receive as a deduction for donating a vehicle.

>> Next Setp: Determine the Value of Your Used Car

Resources: